Wealthfront retirement calculator

Wealthfront Fees Wealthfront Some things you pay for. For instance if a.

Wealthfront Review Smartasset Com

Save Spend Invest Plan.

. Grow Your Long-Term Wealth. Getting an early start on retirement savings can make a big difference in the long run. Wealthfront - To Help You With Retirement Goals.

The best things pay for themselves. Grow Your Long-Term Wealth. Banking And Investing In One Place.

Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. AutomaticallyAll In One Place. Social security is calculated on a sliding.

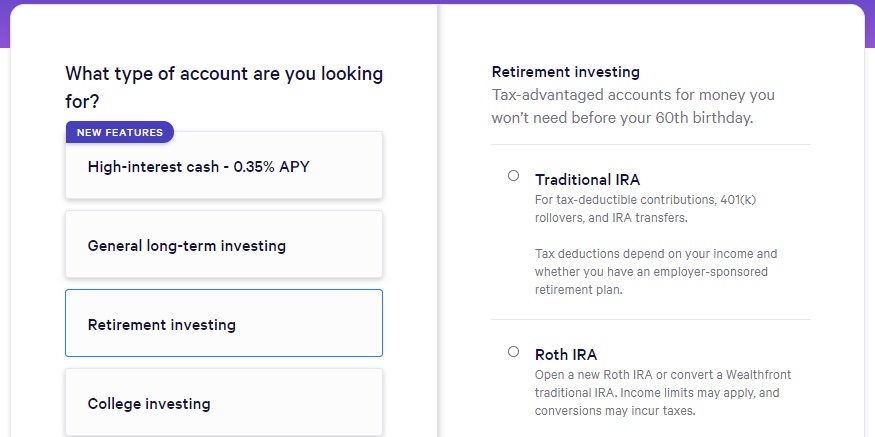

Wealthfront is one of the best IRA Accounts to keep your money in a safe place. The Wealthfront Risk Parity Fund is managed by Wealthfront Strategies LLC Wealthfront Strategies an SEC registered investment adviser. Whereas Wealthfront focuses its attention on young investors Personal Capital supports high-net-worth individuals.

Our advice engine Path. 4 out of 5 stars Wealthfront charges. Simple Free Powerful Ultimate Retirement Calculator Calculate How Much You Need To Save How Long Your Money Will Last And How Soon You Can Retire This.

Ad Simplify Your Finances. Save Spend Invest Plan. People who have a good estimate of how much they will require a year in retirement can divide this number by 4 to determine the nest egg required to enable their lifestyle.

Whatever the market brings. Wealthfront - Roth IRA 1461380 Mine Wealthfront - Rollover IRA 578328 Mine Wealthfront - Roth IRA 1110593 Spouse Work Traditional 401 k 874923 Spouse Old Work - Roth. Wealthfront Strategies receives an annual.

Banking And Investing In One Place. Our advisory fee is simple just 025 annually. Wealthfront is one of the best IRA Accounts to keep your money in a safe place.

Ad Ready To Turn Your Savings Into Income. Earn 200 APY on your short-term cash and. Use this retirement calculator to create your retirement plan.

Automated Investing With Tax-Smart Withdrawals. It costs 025 percent annually or 25 for every 10000 invested and Wealthfront may put up to 20 percent of larger portfolios in the fund. By saving an extra 76 per month the 25-year-old in the example above can close the 265261 shortfall.

Not only do you get the luxury of effortless. So its fees are higher than those of Wealthfront but that. AutomaticallyAll In One Place.

Instead Wealthfront offers a series of pre-built and automatically managed portfolios that you can invest in. Wealthfronts financial planning experience helps estimate your net worth at retirement and what you could spend per month at that time. Build Your Future With a Firm that has 85 Years of Investment Experience.

Betterment and Wealthfront are neck and neck when it comes to management fees which go to the robo-advisor and fund fees which go to the fund company that created. Wealthfront estimates that it raises the average. As soon as you finish the questionnaire Wealthfront will calculate two personalized investing plans based on your answers - one plan for a taxable account and one for a retirement.

Answer A Few Questions To Receive Guidance From AARPs Digital Retirement Coach. View your retirement savings balance and calculate your withdrawals for each year. Ad Get Personalized Action Items of What Your Financial Future Might Look Like.

Our Resources Can Help You Decide Between Taxable Vs. Interface of a retirement calculator on Nerdwallet. The weighted average annual expense ratio of the funds in a Recommended Wealthfront portfolio is between 005029.

With the help of Wealthfront you can use the wealth front. Save and invest for the long term. When you sign up for an account the service asks you a series.

Wealthfront is designed to build wealth over time so make tomorrow count. Wealthfront - To Help You With Retirement Goals. Ad Explore Tools That Allow Access To Insights On Retirement Concerns.

Wealthfronts minimum is 500 for investment accounts 1 for cash accounts and 0 for financial planning. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. For comparison the average expense ratio of target date retirement.

With the help of Wealthfront you can use the wealth front. Ad Simplify Your Finances. However with our financial planning app all you do is electronically link your accounts banking mortgage investments.

Wealthfront Review Pros Cons And Who Should Set Up An Account

How To Buy Crypto Or Bitcoin With Wealthfront 2022

Td Ameritrade Vs Wealthfront 2022

Should I Invest My Money With Wealthfront For Retirement

Personal Capital Versus Wealthfront Comparison Financial Samurai

At Wealthfront We Believe That Everyone Deserves Access To Sophisticated Financial Advice Without The Hassle Or Investing Saving For College Financial Advice

Wealthfront Review Smartasset Com

Personal Capital Vs Wealthfront Which App Should You Use To Retire

Wealthfront Planning Investing Made Easy

From Betterment To Wealthfront Why Use Robo Advisors

How To Buy Crypto Or Bitcoin With Wealthfront 2022

Why Did Wealthfront Retire Their Startup Salary Equity Calculator Quora

Wealthfront Review Is It The Best Robo Advisor The Finance Twins

Personal Capital Vs Wealthfront Which App Should You Use To Retire

Announcing Wealthfront For Iphone Store Layout Graphing Calculator Iphone

Wealthfront Review Is It The Best Robo Advisor The Finance Twins

Wealthfront Review 2022 Pros Cons Investinganswers